Introduction

Large enterprises face constant pressure to sustain innovation and identify new avenues for growth. However, established organizations often struggle to maintain innovation momentum over the long-term.

Potential roadblocks include risk aversion, rigid systems, short-term thinking, misaligned incentives, and organizational inertia [1]. These barriers can prevent companies from successfully incubating transformational innovations internally.

According to research by Harvard Business School, over 75% of corporate venture building efforts fail to meet objectives. Lack of strategic alignment and tension between venturing units and parent companies are frequently cited causes [2].

To overcome these pitfalls, leading enterprises are complementing traditional R&D models with corporate venturing programs. Corporate venturing entails making equity investments in promising external startups to stimulate innovation.

Structured effectively, corporate venturing provides strategic benefits including [3]:

- Faster response to technological disruption

- Improved visibility into emerging competitive threats

- Ability to pilot new innovations at contained risk

- Potential for attractive financial returns

However, simply investing in startups does not guarantee results. Without rigor across opportunity sourcing, investment analysis, portfolio support, incentive design, and learning systems, corporate venturing returns can disappoint [4].

This article provides an in-depth look at how a systematic process developed by leading practitioners can help enterprises navigate corporate venturing successfully. We will cover:

- Key steps in the corporate venturing process

- Practices to align venturing activities with corporate priorities

- Methods to incentivize innovation teams and internal sponsors

- Techniques to maximize learning from venture investments

The B-works Innovation Co-Pilot

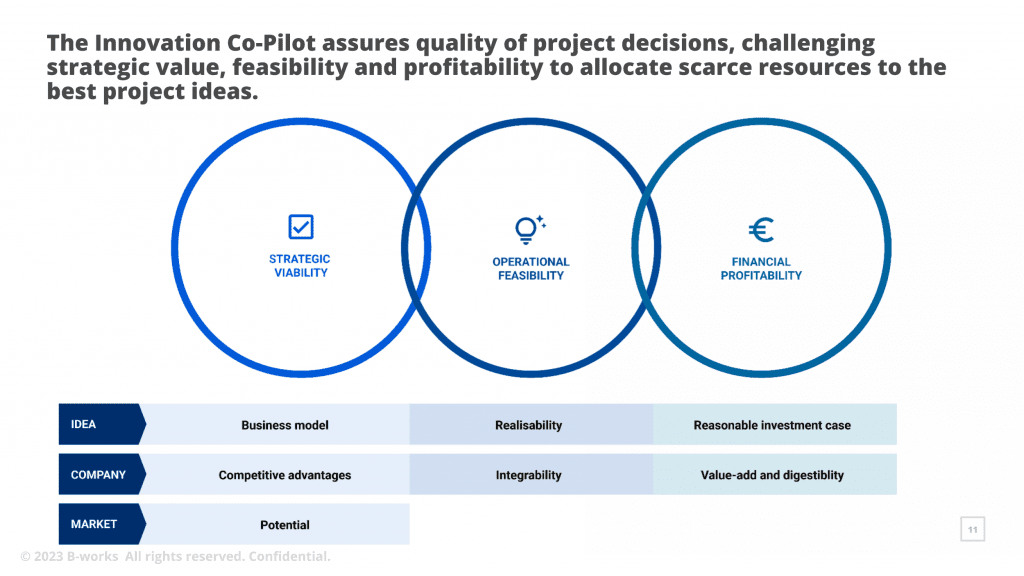

B-works’ corporate venturing process is built on our Innovation Co-Pilot methodology. This structured approach ensures rigorous evaluation so that organizations invest limited resources into only the most promising opportunities.

The Innovation Co-Pilot challenges strategic value, feasibility, and financial return potential of new ideas and business models. Opportunities are assessed across three key dimensions:

Strategic Viability

Evaluates alignment of the business model, competitive position, and market potential with the company’s strengths and strategic objectives.

Operational Feasibility

Analyzes whether the proposed solution can realistically be developed, integrated, and delivered based on the company’s capabilities.

Financial Profitability

Quantifies the revenue model, cost structure, and investment requirements to determine the economic viability of the opportunity.

This multi-faceted analysis prevents organizations from pursuing ventures and technologies that may be interesting but lack strategic relevance or commercial viability within the company’s context.

The Innovation Co-Pilot methodology ensures prudent allocation of resources to only the most promising innovation investments. B-works’ structured process balances creativity with rational rigor to drive sustainable success.

A Structured Corporate Venturing Process

Leading practitioners have developed robust stage-gate frameworks to guide corporate venturing programs from opportunity sourcing through commercialization [7]. These methodologies provide needed rigor and alignment.

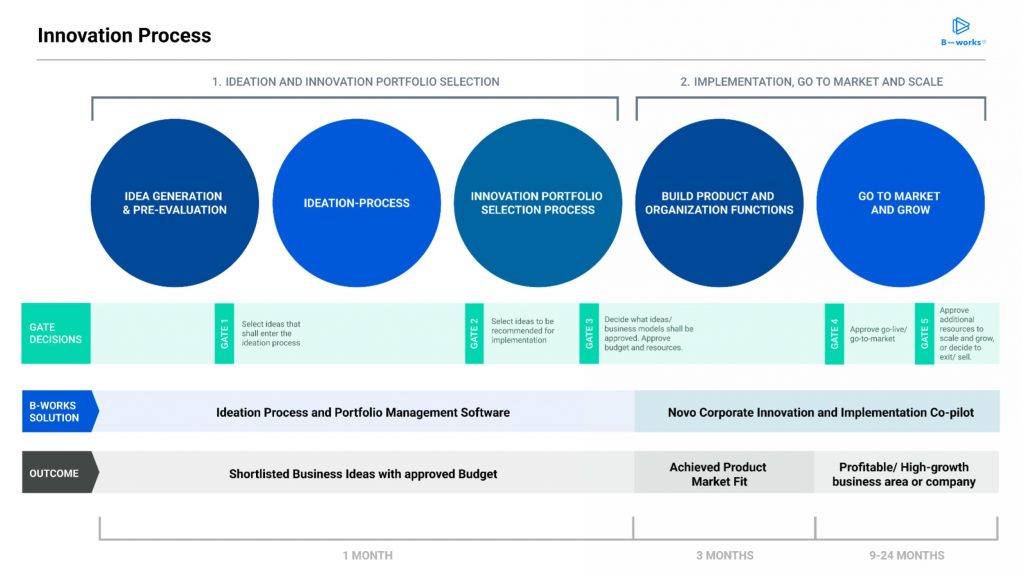

For example, B-works applies a structured process consisting of two integrated sub-processes spanning opportunity sourcing to scaled implementation:

Sub-Process 1: Ideation & Evaluation

This phase follows a stage-gate sequence over approximately 1-2 months to filter and validate ideas. Steps include broad ideation, research to identify problems, prototyping potential solutions, evaluating strategic fit, and securing internal approval.

Sub-Process 2: Implementation & Growth

This phase spans 3-12 months to translate ideas into operating ventures at scale. Steps include structuring new ventures, using agile sprints to build minimum viable products, driving product-market fit, and building out operations.

Together, these sub-processes guide organizations from idea to scaled venture. A recent study found that companies employing stage-gate systems for corporate venturing improve innovation success rates by up to 38% [8].

Let’s dive into Sub-process 1 to understand how a systematic approach identifies and evaluates opportunities effectively.

Sub-Process 1: Ideation & Evaluation

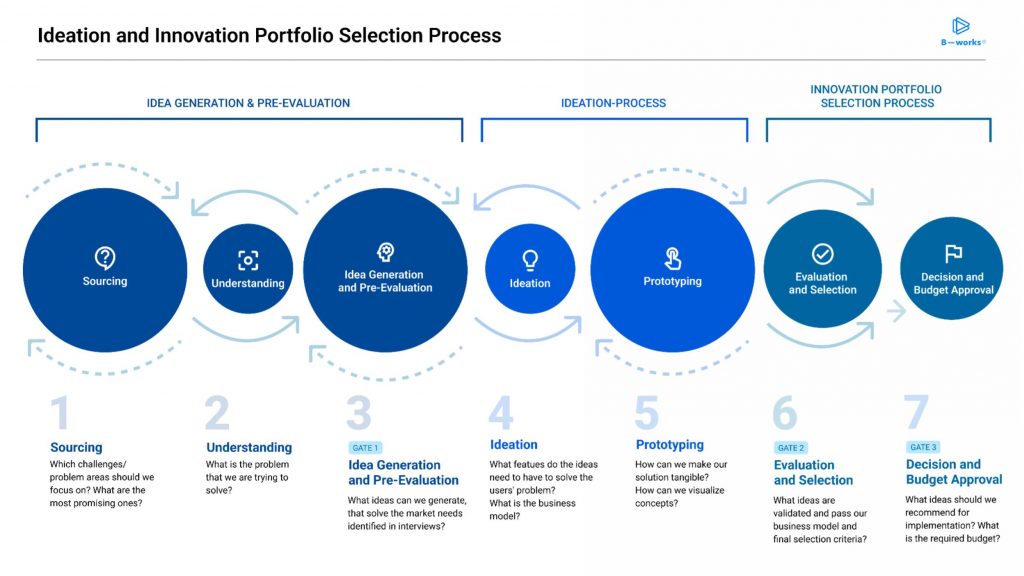

The first sub-process provides a funnel to harvest opportunities from the broad front-end through structured evaluation gates down to a focused set of validated concepts.

Ideation

The process begins by taking an expansive view of possible opportunity areas adjacent to the core business. Facilitated sessions aim to uncover potential market needs and spark new perspectives. Innovation frameworks reveal insights from analogous industries and patterns across emerging innovations. The outcome is a list of high-potential opportunity spaces for further exploration.

Stage Gate 1: Prioritization

Prioritization matrices help rank and select the top opportunity areas based on strategic attractiveness and feasibility. Focus is narrowed to spaces offering the greatest potential.

Problem Research

Having identified promising spaces, ethnographic user research now creates an intimate understanding of problems and needs therein. Immersive studies like diary analysis and ride alongs develop empathy while journey mapping elucidates pain points. Proto-personas represent target users. The outcome is a detailed picture of user problems within prioritized opportunity areas.

Idea Generation

With clearly defined problems, ideation shifts to solving them. Cross-functional sessions encourage out-of-the-box thinking to envision features, products, business models and partnerships that address user and market needs in new ways. Idea clustering reveals themes and patterns. The outcome is a range of ideas to solve identified problems.

Prototyping & Validation

Promising ideas are pressure tested through experimentation. Business model canvases interrogate assumptions while prototypes envision possible user experiences. Testing concepts gathers real user feedback to identify flaws early. The outcome is tangible concepts vetted for product-market fit potential.

Stage Gate 2: Evaluation & Selection

Now thoroughly researched, an analytical model scores concepts on factors like strategic alignment, market potential, and technical feasibility. The top ventures are selected for further diligence based on rigorous data-driven evaluation of fit and viability.

Securing Approval

Final proposals analyze resource requirements, strategic rationale, and expected returns. Packaging concepts in this way clearly communicates opportunities and risks to facilitate internal buy-in. Approved ventures proceed to implementation.

This stage-gate flow expands opportunities broadly then uses research, experimentation, and grounded evaluation to narrow options to those with the highest strategic potential and commercial viability.

Sub-Process 2: Implementation & Growth

The second sub-process takes approved concepts through development, launch, and scaling as independent business ventures over approximately 3-12 months.

Venture Structuring

Business model canvases are developed which detail target customers, value proposition, activities, resources, and revenue streams. Process maps are created to visually define workflows from product development through sales and support. Organizational designs outline team structure, roles, and decision rights. This foundations-first approach sets up ventures for success from the start.

Stage Gate 3: Finalize Venture Plan

Leaders align on business model specifics, multi-quarter rollout roadmap, success metrics, and operations. This ensures the venture plan is fully optimized before major resource commitments are made.

Build Minimum Viable Product (MVP)

Focus is purely on developing an early product with critical features that delivers core value. Continuous customer feedback via surveys, interviews, and usability testing guides iterative enhancement. The result is a live product ready for in-market validation rather than over-engineering upfront.

Build Organization Functions

Essential business functions are structured with clear roles, responsibilities, incentives and metrics. This covers functions like marketing, sales, distribution, HR, IT, and customer support. The goal is providing a lean yet robust operational foundation.

Stage Gate 4: Launch Readiness

Checklists validate operational readiness across all areas including technical stability, support processes, and promotional plan. Any gaps or risks are addressed before launch commitment.

Go-To-Market

Launch campaigns drive product awareness, education, and trial. Advanced analytics assess user behavior to optimize the conversion funnel. Referral programs and viral loops help stimulate organic adoption.

Stage Gate 5: Scale Up or Spin Out/Divest

Traction, revenue, and growth metrics determine whether to scale up or spin out/sell the venture. For winners, expanding operations and headcount fuels growth. Underperformers are discontinued to avoid further investment.

This sequence aims to rapidly validate concepts via field testing and scale those demonstrating product-market fit. The stage gates ensure timely go/no-go decisions at each milestone.

An Integrated Process for Venturing Success

Organizations have unique strengths, capabilities, and strategic contexts. An effective corporate venturing process aligns innovation investment activities with corporate objectives and realities. It provides a funnel to expansively harvest opportunities then narrow options based on rigorous data-driven evaluation.

As described, B-works’ process involves two integrated sub-processes:

Sub-Process 1: Ideation & Evaluation systematically sources opportunities, conducts research to reveal problems, stress tests concepts, analyzes fit, and secures approval.

Sub-Process 2: Implementation & Growth develops ventures, validates product-market fit via field testing, and scales operations for those demonstrating traction.

Stage gates between phases enforce discipline, ensuring alignment and readiness before advancing ventures and allocating additional resources.

While tailored to each company’s needs, common success factors include [10]:

- Maintaining strategic alignment across process stages

- Incentivizing venturing teams for long-term goals

- Tolerating failure but terminating ineffective ventures promptly

- Structuring the venturing unit for organizational fit

- Fostering active collaboration between venturing teams and business units

An integrated process combines opportunity exploration with commercialization. This end-to-end approach moves concepts seamlessly from ideation through scaled implementation.

Overcoming Corporate Barriers

While corporate venturing offers strategic benefits, organizational barriers can undermine success. A systematic process combined with dedicated support from specialists can help overcome obstacles.

Common barriers include [11]:

Misalignment – Venturing activities stray from strategic focus areas or clash with existing business units.

Rigid Systems – Bureaucratic processes hinder agility required for new ventures.

Risk Aversion – Fear of failure suppresses bold thinking and experimentation.

Unclear Decision Rights – Ambiguous authority bogs down approvals and creates internal conflicts.

Inadequate Incentives – Misaligned rewards fail to motivate venturing teams properly.

Insufficient Learning – Lack of mechanisms to capture insights from ventures causes knowledge loss.

Resource Constraints – Venturing units are understaffed due to competing priorities.

Culture Clash – Startup mentality collides with legacy corporate mindsets.

Specialist partners can supplement internal capabilities to help navigate challenges. For example, B-works provides services to support venturing success including:

- Ensuring ventures align strategically through analytical models and collaboration

- Injecting agility via lean product development and experimentation methods

- Quantifying opportunities rigorously to de-risk decision making

- Structuring incentive programs that focus innovation teams

- Creating mechanisms for active knowledge sharing with the parent firm

- Offering on-demand access to talent and resources as needed

- Providing an external perspective to overcome biases

A combination of process excellence and specialist support enables organizations to achieve venturing success. A systematic framework aligned with corporate realities is the foundation. Hands-on guidance from experienced partners helps execute flawlessly.

Realizing the Potential of Corporate Venturing

Corporate venturing holds tremendous potential for driving strategic innovation and revenue growth if executed systematically. However, organizations must implement structured processes to align activities, incentivize teams, and maximize learning.

B-works leverages an integrated framework honed through 50+ successful venturing initiatives. Our guided approach combines:

Proven Stage-Gate Process – Best practice stage-gate framework tailored to each company’s context and goals.

Specialist Teams – On-demand access to talent with skills across opportunity research, venture building, product development, and commercialization.

Accelerators – Methods and tools to compress timelines, including lean experimentation, agile delivery, and growth loops.

Active Knowledge Sharing – Mechanisms spanning project reviews, working sessions, and templates to capture and disseminate insights across ventures.

Incentive Optimization – Performance-based reward programs focused on long-term strategic KPIs versus short-term financial metrics.

Portfolio Management – IT platforms to track ventures and consolidate learnings, metrics, and reports to inform decisions.

This framework integrates state of the art innovation practices within robust stage-gate discipline. The process is tailored to each company’s strengths, objectives and constraints. Hands-on guidance maximizes quality execution.

B-works’ integrated approach enables organizations to overcome inertia, mitigate risks, and capitalize on new opportunities through venturing. To learn more about energizing corporate innovation, get in touch below or schedule a consultation.

Get a free strategy session

References and recommended reading

[1] Christensen, C.M., 1997. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Harvard Business Review Press.

[2] Ernst, H., Witt, P. and Brachtendorf, G., 2005. Corporate venture capital as a strategy for external innovation: an exploratory empirical study. R&D Management, 35(3), pp.233-242.

[3] Dushnitsky, G. and Lenox, M.J., 2005. When do incumbents learn from entrepreneurial ventures?. Research Policy, 34(5), pp.615-639.

[4] Benson, D. and Ziedonis, R.H., 2009. Corporate venture capital as a window on new technologies: Implications for the performance of corporate investors when acquiring startups. Organization Science, 20(2), pp.329-351.

[5] Makinen, S.J. and Dedehayir, O., 2012. Business ecosystem evolution and strategic considerations: A literature review. In 18th International Conference on Engineering, Technology and Innovation (ICE) (pp. 1-10). IEEE.

[6] Ernst, H., Witt, P. and Brachtendorf, G., 2005. Corporate venture capital as a strategy for external innovation: an exploratory empirical study. R&D Management, 35(3), pp.233-242.

[7] Chesbrough, H. and Tucci, C.L., 2004. Corporate venture capital in the context of corporate innovation. European Financial Management, 10, pp.147-157.

[8] Global Startup Studio Network. 2022 GSSN Data Report. [online] Global Startup Studio Network. Available at: https://www.gssn.global/research [Accessed 28 February 2023].

[9] Hutchinson, J. and De Meyer, A., 2012. Ecosystem edge: increasing returns in the border zones. Rotman Magazine, pp.68-71.

[10] Ernst, H., Witt, P. and Brachtendorf, G., 2005. Corporate venture capital as a strategy for external innovation: an exploratory empirical study. R&D Management, 35(3), pp.233-242.

[11] Hill, S.A. and Birkinshaw, J.M., 2012. Ambidexterity and survival in corporate venture units. Journal of Management, 40(7), pp.1899-1931.

Photos and Infographics

- B-works